A Beginner's Guide To The Liquid Network

Liquid Network is a layer-2 solution designed to improve Bitcoin transactions for retail and institutional investors.

Although Bitcoin has become the world’s most popular cryptocurrency, several problems limit its widespread adoption. The biggest of these problems is Bitcoin’s minimal throughput—the Bitcoin blockchain can process just 5-7 transactions per second. For context, centralized payment systems like Visa can process thousands of transactions within the same timeframe.

Bitcoin’s low transaction speed discourages institutional investors, especially those involved in cryptocurrency arbitrage. Retail buyers may also find the lengthy transaction confirmation times off-putting since it harms liquidity and user experience.

The transparent nature of Bitcoin further causes problems for large-scale buyers. Anyone can see address balances and amounts involved in Bitcoin transactions. This puts large orders at risk of front-running and creates privacy concerns for institutional buyers.

Several solutions have been proposed to solve these problems—namely layer-1 and layer-2 solutions.

Layer-1 solutions require rewriting the blockchain protocol to implement changes, such as bigger block sizes or faster block times. While bigger block sizes and faster block times may increase transaction speeds, they tend to affect network decentralization and security. This is why the Bitcoin community rejected the SegWit2X proposal, leading to the hard fork that created Bitcoin Cash.

Layer-2 solutions, however, operate on top of the main blockchain without rewriting the network protocol. Layer-2 networks handle transactions off the main chain—hence, they are also known as “off-chain” solutions. To preserve the security and immutability of transactions, transfers executed off-chain are bundled together and added to the main chain.

Popular examples of layer-2 solutions developed for the Bitcoin blockchain include Rootstock, Lighting Network, and the Liquid Network. This article focuses on the Liquid Network and its implications for the Bitcoin ecosystem.

What Is The Liquid Network?

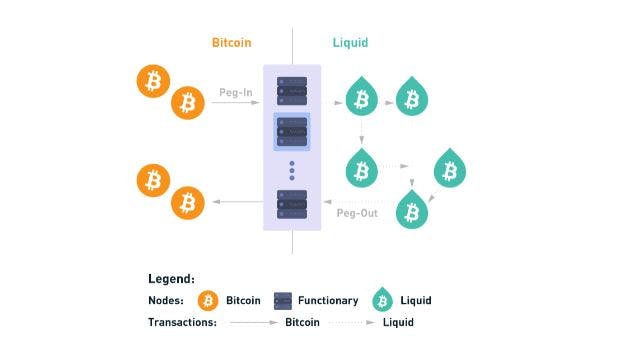

The Liquid Network is a sidechain built on the Bitcoin blockchain. Sidechains are layer-2 networks that interact with the main chain via a “two-way peg.” Assets on a sidechain are pegged 1:1 to the value of the native assets they represent, allowing anyone to use their tokens and coins on another blockchain.

The Liquid Network is designed to enable fast, private, and secure issuance, transfer, and exchange of cryptocurrencies, stablecoins, digital assets, and security tokens on the Bitcoin blockchain. While Liquid Network operates atop Bitcoin’s base layer, it operates independently and uses different methods to achieve higher throughput and more confidential transactions.

Liquid Network primarily serves institutional investors, exchanges, cryptocurrency traders, and other enterprise clients who desire a higher level of privacy and faster transactions. Retail investors cannot directly use the Liquid Network, except they go through a member of the Liquid Network.

How Does Liquid Network Work?

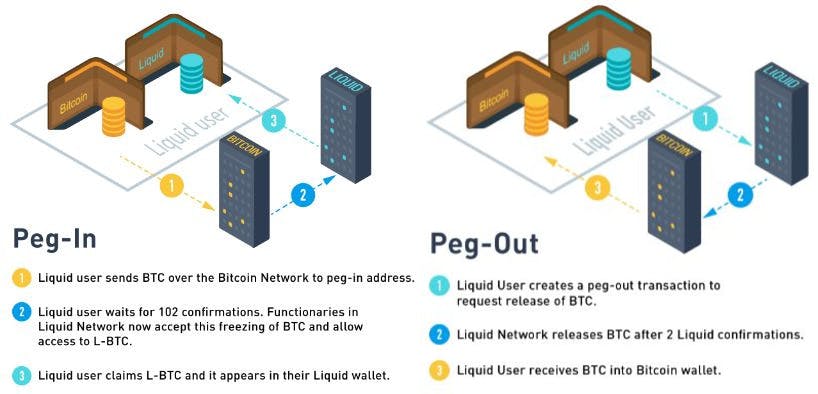

Essentially, what Liquid Network does is issue a “wrapped” version of BTC called L-BTC that can be used on its chain. To use Liquid Network, users initiate a “peg-in”, which involves sending BTC to a Lightning Network address on the Bitcoin blockchain. Once the transaction receives 102 confirmations, an equal amount of L-BTC is minted on the Liquid Network and sent to the user’s address.

L-BTC owners are free to use this tokenized BTC however they want on the Liquid Network. They may use it to trade on a Liquid-compatible exchange or buy assets and digital collectibles issued on the chain.

If a user wishes to withdraw their BTC, they initiate a “peg-out”, which starts with sending L-BTC to an unretrievable address for burning. Once this transaction receives two separate confirmations, a Lightning Network member sends the original BTC to the user’s address on the Bitcoin blockchain.

Unlike Bitcoin, Liquid Network uses a different method for generating new blocks. Transactions are bundled together into blocks and signed by the 15 Liquid Network Functionaries. These Functionaries run full nodes and are responsible for validating new transactions and broadcasting new blocks on the chain.

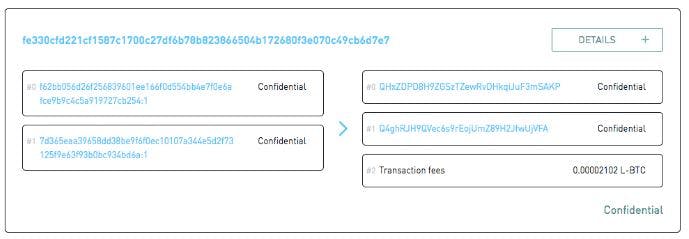

Additionally, Liquid uses Confidential Transactions to increase the privacy of Bitcoin transactions. This feature hides key transaction details, such as the amount transferred, the number of parties involved, and the balances left in users' addresses. However, network validators can still validate transaction amounts, total supply, and wallet balances.

Advantages of Using Liquid Network

Faster Transactions

Liquid Network uses Signed Blocks, which cut down the time it takes to validate and process transactions. New blocks are confirmed in around two minutes, unlike the 10 minutes it takes to add a block to the Bitcoin blockchain.

Liquid's faster transactions make it an ideal choice for arbitrage traders who need to perform cross-exchange trades quickly to make profits. With its long confirmation time, Bitcoin is ill-suited to the needs of such people, as trading advantages can be lost in mere minutes.

Retail investors who want faster transactions without converting their BTC to risky altcoins can transact using L-BTC on supported exchanges. This means they can make transfers and buy assets without delays and still enjoy the security of the Bitcoin blockchain.

Greater Privacy

Satoshi Nakamoto, Bitcoin’s inventor, designed Bitcoin as a public ledger of sorts. This improves transparency since anyone can map transactions to individual addresses and even check wallet balances.

However, Bitcoin’s transparency can cause headaches, especially for entities conducting large-scale transactions. For example, a third party can use information gleaned from analyzing transactions to gain a market advantage, called frontrunning. Frontrunning is disadvantageous to investors and discourages them from adopting Bitcoin.

Liquid Network implements Confidential Transactions to conceal key transaction information from outsiders. As such, only the sending address, receiving address, and transaction fee are recorded on-chain for transparency. The remaining details, such as the asset type and amount, are visible only to the parties involved in the transaction.

Reduced Transaction Fees

A hidden benefit of Liquid’s higher throughput is the lower fees paid on transactions. When the Bitcoin network gets clogged with unconfirmed transactions, miners will charge higher fees to prioritize some transactions. This has caused Bitcoin transaction fees to spike in the past, especially during bull runs.

Liquid’s novel consensus mechanism (block signing) increases transaction speed, so users don’t have to pay extra to process transactions quickly. Low Liquid Network fees are ideal for retail and institutional investors wanting to trade BTC without using other blockchains. While new-generation chains may promise lower transaction fees, they cannot offer Bitcoin’s security and liquidity.

Trustless Atomic Swaps

Atomic swaps provide a way for people to swap cryptocurrencies without relying on an exchange or another trusted intermediary. Liquid users can conduct trustless, peer-to-peer Atomic Swaps using the open-source Liquid Swap tool.

For example, users can exchange tokenized versions of BTC (L-BTC) and USDT (L-USDT) on the Liquid Network. This can create more liquidity for entities and make it easier to trade BTC for other assets.

Issuance of Assets

Liquid Network facilitates the issuance of digital assets, which would be impossible to do on Bitcoin, given the latter’s limited functionality. Users can issue, buy, and exchange the following assets on Liquid: utility tokens, security tokens, stablecoins, and digital collectibles (NFTs).

Limitations of the Liquid Network

The Liquid Network runs a federated system, where 15 Functionaries are responsible for adding new transactions and maintaining the ledger. While this system reduces confirmation time, it is highly centralized and subject to the control of a few parties.

Other concerns relate to Liquid’s single points of failure. Bitcoin is difficult to shut down or hack because there are thousands of nodes (computers) sustaining the network. Liquid relies on just 15 computer hubs, which increases the risk of censorship and malicious attacks.

Liquid Network vs Lightning Network

Like Liquid, Lightning Network is a layer-2 network operating on top of the Bitcoin blockchain. However, these off-chain solutions have different goals. While Lightning enables Bitcoin micropayments, Liquid focuses on transactions involving large amounts of Bitcoin.

Lightning and Liquid also have different target users. Small businesses have found Lightning Network’s payment channels incredibly useful for processing Bitcoin payments. Conversely, enterprises, such as financial institutions and cryptocurrency exchanges use Liquid to execute private and faster transactions.

Who Controls the Liquid Network?

Liquid Network is the brainchild of Blockstream, a blockchain solutions company headed by Adam Back. Back developed Hashcash, which inspired Bitcoin’s proof-of-work consensus, and was one of the few people Satoshi Nakamoto contacted while working on Bitcoin.

While Blockstream created Liquid, the network is run by the Liquid Network Federation. The Liquid Federation comprises 15 validators (“Functionaries”); regular members who can vote on network updates; and nodes that verify the state of the network.

While anyone can run a Liquid node and monitor the network, only the 15 Functionaries running full nodes can create new blocks. This position is regularly rotated among Federation members to achieve some measure of decentralization.

Any Liquid Network Federation member (not necessarily a Functionary) can process peg-in and peg-out transactions (converting BTC to L-BTC). This requires that Federations keep pre-funded wallets on both Bitcoin and Liquid, so users can receive their wrapped or unwrapped assets quickly.

Final Thoughts

The Liquid Network has emerged as a popular solution for scaling the Bitcoin network and adapting it to enterprise needs. Liquid improves Bitcoin without modifying the underlying protocol and affords users extra functionality without sacrificing security.

Liquid also introduces programmable functionality, tokenization, and interoperability to Bitcoin. This may strengthen it against Ethereum, Solana, Cardano, and other newer rivals and preserve its status as the world’s leading blockchai

[

[ [

[ [

[ [

[